Former Fidelity Investments CEO dies at 91

March 30, 2022

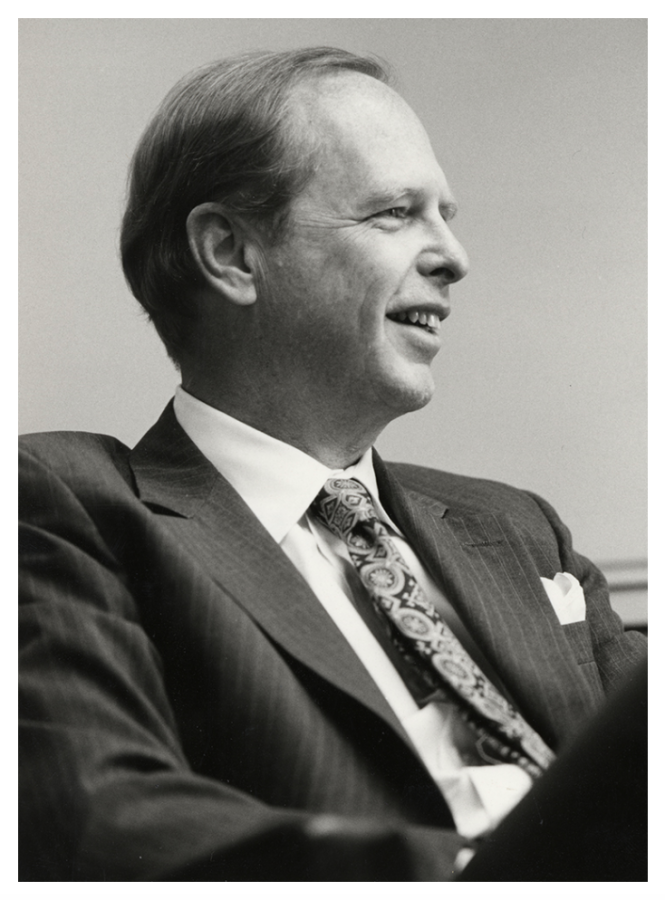

Former Fidelity Investments Inc. CEO and chairman Edward “Ned” Johnson III, who led the company for 42 years, died in Florida at the age of 91 while surrounded by his family on March 23.

Johnson was born in Boston, Massachusetts during the Great Depression and went on to work for his father Edward Johnson II at his investments firm, Fidelity, in 1957 as a portfolio manager. In 1972, the younger Johnson became the president of Fidelity.

When his father retired in 1976, Johnson went on to become the company’s chairman and CEO. The positions of Fidelity CEO and president are now held by his oldest daughter, Abigail Johnson, who has held the roles since Oct. 13, 2014.

“We are immensely proud of his achievements and grateful for his life,” his family said in a statement. “He was a visionary, an innovator, and a philanthropist who had tremendous curiosity about the world around him and who lived his life to the fullest each and every day. To the end, he never lost his enthusiasm, his sense of humor, or his energetic spirit.”

Johnson is largely credited for the growth of Fidelity from a Boston-based business into the Wall Street giant it is today.

Right around the time that Johnson took over the company, Congress created the Individual Retirement Account, which moved companies away from traditional pension plans. This is when 401(k) accounts, which is an “employer-sponsored retirement plan that invested in stocks and bonds but was ultimately run by the individual employee,” first materialized, according to reporting from NBC News.

As a result, there was an increased interest in investing from average people during the 1980s. Fidelity began to sell mutual funds directly to the public and offer discount brokerage services that made investing in stocks cheaper for people.

Fidelity was also the first fund company to create its own website.

“He was playing three-dimensional chess when other people were playing checkers,” former Fidelity Investments President of National Financial Services Sanjiv Mirchandani said in a memorial video created by Fidelity. “He thought several moves ahead and thought of all of the variables, but he also recognized that in a world of uncertainty and complexity that you need a true north, you need a compass.”

By the end of Johnson’s career and life, Fidelity grew and became immensely successful. When Johnson became president in 1972, Fidelity had $3.9 billion in assets under management. By the time Johnson retired as chairman in 2014, Fidelity had $2.1 trillion in assets under management and $5.7 trillion in assets under administration.

Fidelity currently has $11.1 trillion in assets under administration, as of February.

“Through his vision of making investment products and services accessible and affordable to average Americans, he helped spur the explosive growth of personal investing over the past four decades,” a statement from Fidelity read.

Johnson is survived by his wife, Elizabeth “Lillie” Johnson, and their three children, Abigail Johnson, Elizabeth Johnson and Edward Johnson IV.