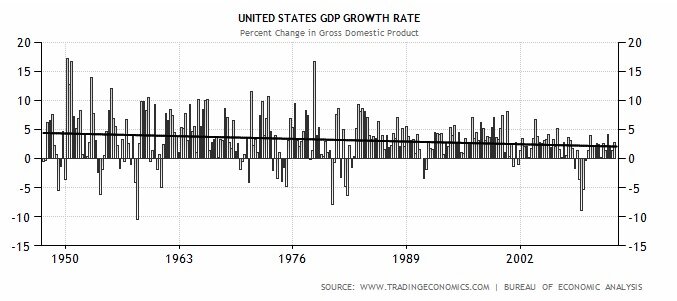

The U.S. economy for the second straight year hasn’t notched the 3% yearly growth target the president has set since taking office in 2016.

For 2019, the U.S. economy grew moderately gaining 2.1% for the fourth quarter of 2019. This was due to the current trade war between China and the United States, lower business confidence and investment, and cooling consumer spending.

Business investment fell by 1.5% in the fourth quarter of 2019. It was the third straight quarterly decline and the longest such stretch since the year 2009. This can be largely attributed to trade uncertainty and news headlines.

The National Association of Business Economics found that 84% of respondents, who were business execs, weren’t planning to further spend from capital budgeting despite reported accelerating investment retained earnings because of lower corporate taxes.

Boeing Co. suspended this month the production of its troubled 737 MAX plane. Boeing reported its first annual loss since 1997 on Jan. 29.

U.S. economists estimate Boeing’s biggest assembly line halt since the 1990s could slice at least half a percentage point from first quarter gross domestic product growth in 2020.

The spending done among consumers also fell from 3.2% to 1.8% in the third quarter of 2019.

This, if continually occurring, could have a more pronounced effects as consumption is two-thirds of U.S. GDP.

President Donald Trump highly covets his $1.5 trillion cut legislation as a huge economic booster, but it has yet to reach his target. It has only been a temporary boost. 2018 was the best year in terms of reaching the 3% goal, with gained 2.9%.

The Department of Commerce noted that the year 2019 only had a 2.3% growth.

However, this is not inherently a negative thing. 2% growth is seen widely as a stable and moderate among economists.

Larry Kudlow, the current White House economic adviser calls it, “fundamentally healthy.”

He is very optimistic and has a strong position for better days just like the president does.

Trump described last Friday’s report as “not bad” and had the notion that the economy is “set to zoom,” according to an article by the Washington Post.

This will likely be the norm for this decade compared to the fast-growing emerging economies occurring India, China and Brazil who will begin to take the world by storm over the coming years.

Some economists have been vocal about their disagreement with tax cuts.

The reduction of the corporate tax rate to 21% from 35% in 2018, as well as shrinking the trade deficit, did not boost annual GDP growth to 3.0% on a sustainable basis. This has been due to low productivity and low population growth.

Based on historical data and trends, that there has not been a very strong correlation between corporate tax rates and business investment.

This is very similar to trickle-down economics which isn’t proven to work.

Apple Inc. most notably is known to use their tax break for share buybacks, according to Reuters.

There have been many macroeconomic events that rocked the world since 2020 began that also must be accounted for, such as the United Kingdom leaving the European Union, the emergence of the coronavirus and interests rates staying low by the central banks around the world.

It remains unknown what the future entails for the rest of this year, and only time will tell how the United States will fare in 2020 and the years ahead.